In Forex trading, repainting indicators are technical indicators that change their values after the price data has closed. This means that the indicator's signals are not based on real-time market data, but rather on historical data that may have already changed. This can be misleading for traders, as it can make it appear that the indicator is more accurate than it actually is.

Types of repainting indicators:

- Indicators that are based on the current close/high/low prices: These indicators will change their values as the current market price changes. For example, Bollinger Bands will show wider bands if the price moves sharply during the day, even if the current candle has not yet closed.

- Indicators that look ahead to future candles: These indicators use data from future time periods, which makes them inherently unreliable. For example, the Ichimoku Kinko Hyo indicator may show the "clouds" crossing in the future, which would be a buy signal, but this may not actually happen.

Why repainting indicators can be dangerous:

- False signals: Repainting indicators can generate false buy or sell signals, which could lead traders to enter or exit trades at inopportune times.

- Difficulty testing strategies: It is difficult to properly backtest trading strategies that rely on repainting indicators, as the results of the backtest may vary depending on the market data used.

- Frustration: Traders may become frustrated if they notice that the indicator's signals are constantly changing, which could lead to them losing confidence in themselves and making rash decisions.

Examples of repainting indicators:

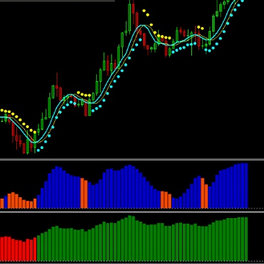

- Bollinger Bands: Bollinger Bands can change significantly as the current market price changes, which can lead to false signals.

- MACD indicator: The MACD indicator may show false crossovers of its lines.

- Ichimoku Kinko Hyo indicator: The "clouds" and Senkou Sen lines in the Ichimoku Kinko Hyo indicator can change.

How to avoid repainting indicators:

- Use non-repainting indicators: There are many technical indicators that do not repaint their values, such as moving averages and moving average crossovers.

- Confirm signals with other indicators: Do not rely on just one indicator to make trading decisions. Compare the signals from a repainting indicator with other indicators and price action.

- Be aware of the limitations of indicators: Remember that all technical indicators are probabilistic tools, not guaranteed predictions.

In conclusion, it is important to be aware of the dangers of repainting indicators and to use them with caution. Be sure to combine them with other analytical tools and make informed decisions based on your understanding of the market and its conditions.